Building resilient communities through strategic partnerships

Ophea is pleased to announce our new partnership with Meridian Credit Union! Meridian is helping Canadians get ready for life’s "what ifs". By working together to provide access to financial literacy educational supports, Ophea’s Wallet Wellness resource will help to provide Ontario students with a strong understanding of financial basics in order to successfully navigate today’s complex financial world.

Meridian Credit Union is Ontario’s largest credit union dedicated to genuinely and proactively advising their Members on ways to save money, invest in their future, and help them meet their goals. As the exclusive supporter of Ophea’s free Wallet Wellness financial literacy resource, Meridian is excited to share and build the understanding of financial literacy in Ontario school communities. Through this important collaboration, Meridian will support more than 1.4 million students in Ontario’s publicly funded elementary schools to build the skills they need to foster their financial, mental, and physical well-being for life.

“Meridian is extremely excited about this opportunity to help Ophea support and provide children with improved financial education and resources that will help them navigate their everyday lives. As a financial institution committed to financial literacy, we value partnerships with organizations like Ophea that share our commitment to transforming the lives of Ontario youth. With this integral partnership between Meridian and Ophea, we are hoping to help build and shape future financial leaders who are able to do good for themselves and for the betterment of their communities. Through this partnership, Meridian is pleased to be a part of this initiative.”

Ian McCann, Manager, Community Investment and Partnerships, Meridian Credit Union

This school year, through this partnership, Ophea and Meridian will be providing Ontario schools with:

-

A digital version of the Wallet Wellness Activity Booklet that can be used at home with families and by Meridian Members who are parents/caregivers.

-

Incentives to schools participating in a financial literacy classroom contest this November which will allow students to apply their skills and knowledge gleaned from Wallet Wellness. Thanks to Meridian Credit Union, multiple Ontario classrooms have the chance to win through a random draw!

-

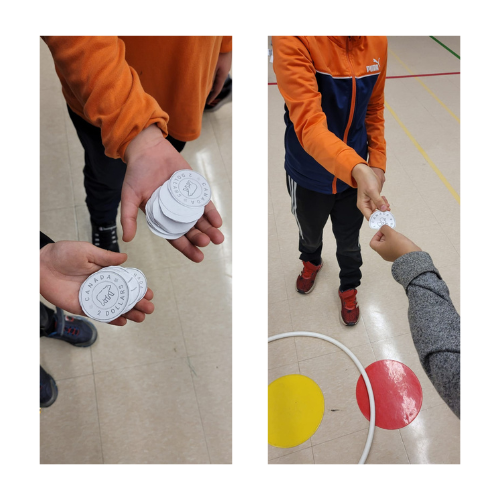

Content updates and continued delivery of the Wallet Wellness resources, which includes free access to the activity cards, student learning videos, and take-home activities which connect to Grades 1–8 Health and Physical Education (H&PE), Math, and Language curriculum.

"We are excited to share and build the understanding of financial literacy education in Ontario school communities. Through this important collaboration, Meridian Credit Union will support not only access to timely, relevant, and trusted information and tools but also the strategies to implement them; helping students explore practical situations and use critical thinking skills to make financial choices and decisions."

Chris Markham, Executive Director and CEO, Ophea

This partnership will help empower Ontario students to make more informed financial decisions in their current and future lives. This program is designed to teach financial tools, techniques, and strategies in a way that is innovative, easily understood, and impactful. With this integral partnership between Meridian and Ophea, we are hoping to help build and shape future financial leaders who are able to do good for themselves and for the betterment of their communities.

“Wallet Wellness is a valuable resource that provides opportunities for students to build their financial literacy while tying in numerous co-curricular expectations. As a teacher, I found the lessons engaging for my students, providing meaningful opportunities for them to learn about different forms of currency and to make simple transactions. The lessons helped students strengthen their basic math skills and practice real life decision-making skills. Each lesson in the resource provides take-home activities, where the learning can continue at home with families, providing them with rich extensions that will definitely continue the financial literacy conversation at home. As a parent, these take-home activities give us ideas on how we can continue assisting our children toward becoming financially literate individuals.”

Nancy Zabukovec, HPE Educator, St. Timothy School, Dufferin Peel Catholic District School Board

Connect your class to Financial Literacy Month in November and be sure to sign up for Ophea’s monthly e-newsletter and follow us on Twitter, Instagram, and Facebook to stay up-to-date with the latest developments out of this partnership – including contest guidelines and prizes, and the release of the digitized Wallet Wellness Activity Booklet!